CUHK MSC

DSBS

M.Sc. in Data Science andBusiness Statistics

OVERVIEW

Data Science is an integrated science which incorporates knowledge from the fields of statistics, mathematics and computer science to develop the necessary skills to find unseen pattern, derive meaningful information and make business decisions. The programme provides fundamental knowledge and computing techniques required for data scientists.

The M.Sc. in Data Science and Business Statistics programme offered by the Department of Statistics at the Chinese University of Hong Kong was launched in 2004 and has been well received by the public. Graduates are equipped with advanced statistical techniques that allow them to play a significant role in the industry.

FEATURES

Part-time (2 years)

Each course consists of a three-hour lecture each week

Weekday evenings & Saturdays at CUHK in Shatin

CURRICULUM

MODE OF STUDIES

PART-TIME MODE

It is a two-year part time taught master degree programme. Students should satisfy the following requirements in order to obtain the degree.

1ST YEAR

Core courses: 9 credits;Elective courses: 3 credits

2ND YEAR

Elective courses: 12 credits

TOTAL24 CREDITS

Note: Students are required to complete a minimum of 24 credits in order to graduate.

SUGGESTED STUDY PLAN

1st Year of Attendance

Term 1: STAT5101, STAT5106

Term 2: STAT5102 and one elective

2nd Year of Attendance

Two electives in each term

CORE COURSES

STAT 5101

STAT 5101FOUNDATIONS OF DATA SCIENCE

This course introduces the statistical reasoning powers in contemporary data science and the use of applied statistical methodologies as a comprehensive approach in data analysis. It provides students with the foundation knowledge to further apprehend in-depth material presented in other courses of the program. Topics include exploratory data analysis, statistical graphics, basic concept in probability, discrete/continuous probability distribution, point and confidence interval estimation, hypothesis testing for one/two sample. The effective use of desktop productivity tools, such as R and Microsoft Excel, in the workplace environment for collecting and analysing corporate data with aforementioned fundamental statistical concepts will be emphasized.

STAT 5102

STAT 5102REGRESSION IN PRACTICE

This course introduces applied regression methodologies using various functional areas of business as the frame of reference, including management, finance and marketing. Topics include the use of correlation coefficient as a measure of relationship, the use of simple linear regression, multiple regression and logistic regression in business projection and forecasting, as well as the use of model building techniques to incorporate qualitative variables in prediction.

STAT 5106

STAT 5106PROGRAMMING TECHNIQUES FOR DATA SCIENCE

This course teaches programming fundamentals for data scientists. Students will learn programming techniques with emphasis on data source connection, data pre-processing pipeline, exploratory data analysis, data visualizations and data reporting. Topics include basic concepts for programming, lists, objects, dictionaries and functions, matrix and data frame, use of programming packages and libraries, database manipulation, API connection and web scraping, descriptive statistics, simulation and Monte Carlo methods, and statistical graphics.

ELECTIVE COURSES

STAT 5103

STAT 5103HIGH-DIMENSIONAL DATA ANALYSIS

Beginning with an introduction to the basic knowledge in multivariate and high-dimensional data analysis, including multinormal distribution, descriptive statistics, and graphical displays, this course focuses on the dimensionality reduction methods, which are commonly used in high-dimensional data analysis. Selected topics include principal component analysis, factor analysis and canonical correlation analysis.

STAT 5104

STAT 5104DATA MINING

Data Mining is a relatively new subject focusing on data collection, storing and automatic algorithms for finding patterns and relations in data. Because of the cheap computing power, the applications of data mining techniques are getting surprisingly board, including policymaking, business decision-making, marketing and stock trading. In this course we introduce the basic ideas and techniques of data mining. The students shall have hands on experience with interesting data sets and learn how to use some of the publicly available software to do data mining with their own data sets.

STAT 5105

STAT 5105APPLIED SURVIVAL DATA ANALYSIS

This course deals with the analysis of time-to-event (survival or failure-time) data, which are commonly encountered in scientific investigations and risk management. It is being extensively used in clinical trials, biological and epidemiological studies, engineering, finance and social sciences. This course provides an opportunity for students to learn statistical lifetime probability distributions that are useful for modeling time-to-event data. The primary focus of the course is on the statistical methods designed for extraction of information from time-to-event data. This course introduces statistical theory and methodology for the analysis of time-to-event data from complete and censored samples with emphasizes on statistical lifetime distributions, types of censoring, graphical techniques, nonparametric/ parametric estimation, lifetime regression models and related topics.

STAT 5107

STAT 5107DISCRETE DATA ANALYTICS

This course provides a practically oriented treatment of modern methods for the analysis of categorical data. Topics include analysis of two-way contingency tables, logistic regression, log-linear model, generalized linear model, classification and regression tree method.

STAT 6104

STAT 6104FINANCIAL TIME SERIES

This course deals with the methodology and applications of business and financial time series. Topics include statistical tools useful in analysing time series, models for stationary and non-stationary time series, seasonality, forecasting techniques, heteroskedasticity, ARCH and GARCH models, and multivariate time series.

STAT 6105

STAT 6105BASIC ACTUARIAL PRINCIPLES AND THEIR APPLICATIONS

This course introduces the basic actuarial principles applicable to a variety of financial security systems. Focus will be on topics related to life insurances and annuities. It also develops students’ understanding of the purpose of these systems, and the design and development of financial security products. Topics include theory of interest, survival distribution and life tables, life insurance, life annuities, and benefit premiums.

STAT 6106

STAT 6106APPLIED BAYESIAN METHODS

This course is an introduction to practical Bayesian methodology. The use of conjugate families is discussed. Building on techniques in Statistical Computing, methods for calculating posterior distributions are presented, as is the concept of hierarchical model. The emphasis throughout is on the application of Bayesian thinking to problems in data analysis.

STAT 6107

STAT 6107SELECTED TOPICS ON DATA SCIENCE AND BUSINESS STATISTICS

Recent topics on data science and business statistics are selected for discussion.

STAT 6108

STAT 6108OFFICIAL STATISTICS AND STRUCTURAL EQUATION MODELLING

The course introduces the basic principles, concepts and methodologies of official statistics and business statistics. The course is divided into two parts, “Official Statistics” and “Structural Equation Modelling”

STAT 6207

STAT 6207Applied Deep Learning

This course provides understanding of practically oriented machine learning and deep learning algorithms. The first part of the course focuses on the theory such as linear classification and deep learning. The second part focuses on applications, such as, recommender systems, generative adversarial networks, and reinforcement learning.

RMSC 5101

RMSC 5101STATISTICAL METHODS IN RISK MANAGEMENT AND FINANCE

This course is designed to introduce the current developments in risk management in the financial markets. Risk management ideas associated with three general important areas in finance will be discussed: asset management, derivative pricing, and fixed income models. Emphasis will be placed on the statistical modelling aspects on some of the commonly used models in these areas.

RMSC 6001

RMSC 6001INTEREST RATE AND FIXED INCOMES RISK MANAGEMENT

Fixed income securities are highly sensitive to the fluctuation of interest rates. Thus interest rate modeling becomes crucial for pricing and managing fixed income securities. This course introduces various types of fixed income securities and interest rate models. It covers the celebrated Heath-Jarrow-Morton (HJM) model as well as some term-structure models including Ho-Lee, Hull-White and the CIR models.

RMSC 6003

RMSC 6003RISK MANAGEMENT IN FINANCIAL INSTITUTIONS

The course aims to discuss how risk management is applied in the banking sector.

RMSC 6004

RMSC 6004SPECIAL TOPICS IN RISK MANAGEMENT

The course aims at discussing recent advances in risk management.

RMSC 6007

RMSC 6007RISK AND FINANCIAL DATA ANALYTICS WITH PYTHON

The aim of the course is to provide students with a broad understanding of the principles and techniques of Python coding for finance applications on Jupyter notebook and/or other programming interfaces. Following an introduction to the basics of Python, the course is further divided into two main sections. The first part covers the fundamentals of data reduction and modelling applied specifically to financial data with Python libraries. Techniques for derivative pricing, risk measures estimation with Python are also discussed. The second part emphasises on several specific examples of applying state-of-the-art machine learning tools for various modelling/ analyses. Understanding the problems covered in the course will be important to students pursing a career in a rapidly expanding technology-intensive field of finance and risk management.

OTHER UNIVERSITY REQUIREMENTS

(a) Students much fulfill the Term Assessment Requirement of the Graduate School. For details, please refer to Section 13.0 Unsatisfactory Performance and Discontinuation of Studies of the General Regulations Governing Postgraduate Studies which can be accessed from the Graduate School Homepage: http://www.gs.cuhk.edu.hk/.

(b) A student must achieve a cumulative grade point average (GPA) of at least 2.0 in order to graduate.

ADMISSIONS

PROCEDURE

Applicants can submit online applications at Graduate School webpage: https://www.gradsch.cuhk.edu.hk/OnlineApp/login_email.aspx .

Scanned copies of the supporting documents should be uploaded to the Online Application System for Postgraduate Programmes. For the list of required supporting documents, please refer to Graduate School website https://www.gs.cuhk.edu.hk/admissions/admissions/documents-required .

APPLICATION TIMELINE

The application deadline for 2025/26 admission

PRIORITY ROUND

31 Dec 2024

FINAL ROUND

28 Feb 2025

Applications will be processed on a rolling basis until all places have been filled. Early applications are strongly suggested.

TUITION FEE

The tuition fee for 2025/26 admission:

HKD 90,000 per year for two years

CONTINUING EDUCATION FUND (CEF)

STAT5101 Foundations of Data Science

CEF Course Code 42Z124710

STAT5102 Regression in Practice

CEF Course Code 42Z124729

These two courses have been included in the list of reimbursable courses under the Continuing Education Fund.

The mother programme (Master of Science in Data Science and Business Statistics) of these courses is recognized under the Qualifications Framework (QF Level 6).

REQUIREMENTS

Applicants are required to fulfil the General Admissions Requirements and the English Language Requirements for Admission.

GENERAL ADMISSION REQUIREMENTS

- graduated from a recognized university and obtained a bachelor’s degree, normally with honours not lower than Second Class or achieving an average grade of not lower than “B”; or

- completed a course of study in a tertiary educational institution and obtained professional or similar qualifications equivalent to a bachelor’s degree.

ENGLISH LANGUAGE REQUIREMENTS FOR ADMISSION

To fulfill the University’s minimum English language requirements for admission to postgraduate programmes, applicants should have:

- obtained a degree from a university in Hong Kong1 or taken a degree programme of which the medium of instruction was English; or

- achieved scores in the following English Language tests2 as indicated:

- TOEFL: 550 (Paper-based)/79 (Internet-based);

- IELTS (Academic): 6.5;

- GMAT: Band 21 (Verbal); or

- obtained a pass grade in English in one of the following examinations:

- Hong Kong Advanced Level Examination (AS Level);

- Hong Kong Higher Level Examination;

- CUHK Matriculation Examination;

- General Certificate of Education Examination (GCE) Advanced Level (A-Level)/Advanced Subsidiary Level (AS-Level); or

- achieved Level 4 or above in the English Language subject of the Hong Kong Diploma of Secondary Education (HKDSE) Examination; or

- obtained a recognized professional qualification, provided that the examination was conducted in English.

Notes:

1. This is based on the understanding that English is the medium of instruction of degree programmes offered by universities in Hong Kong. Moreover, graduates from universities in Hong Kong should have fulfilled the English language requirements of the institution concerned when they were admitted to the degree programmes. The CUHK Graduate School may request applicants to provide additional supporting documents to prove their English proficiency.

2. TOEFL and IELTS scores are considered valid for two years from the test date. GMAT scores are considered valid for five years from the test date.

PROGRAMME LEAFLET

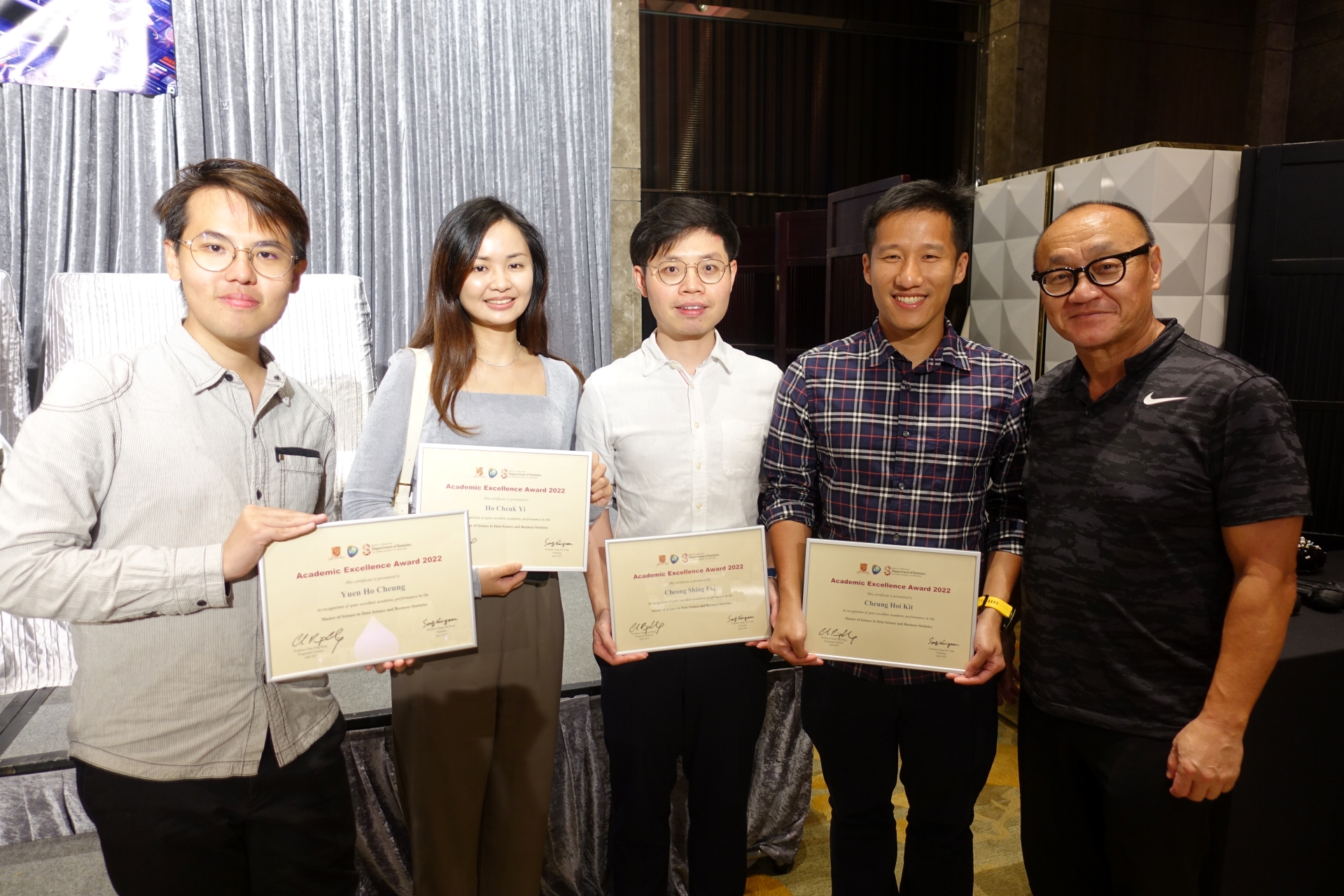

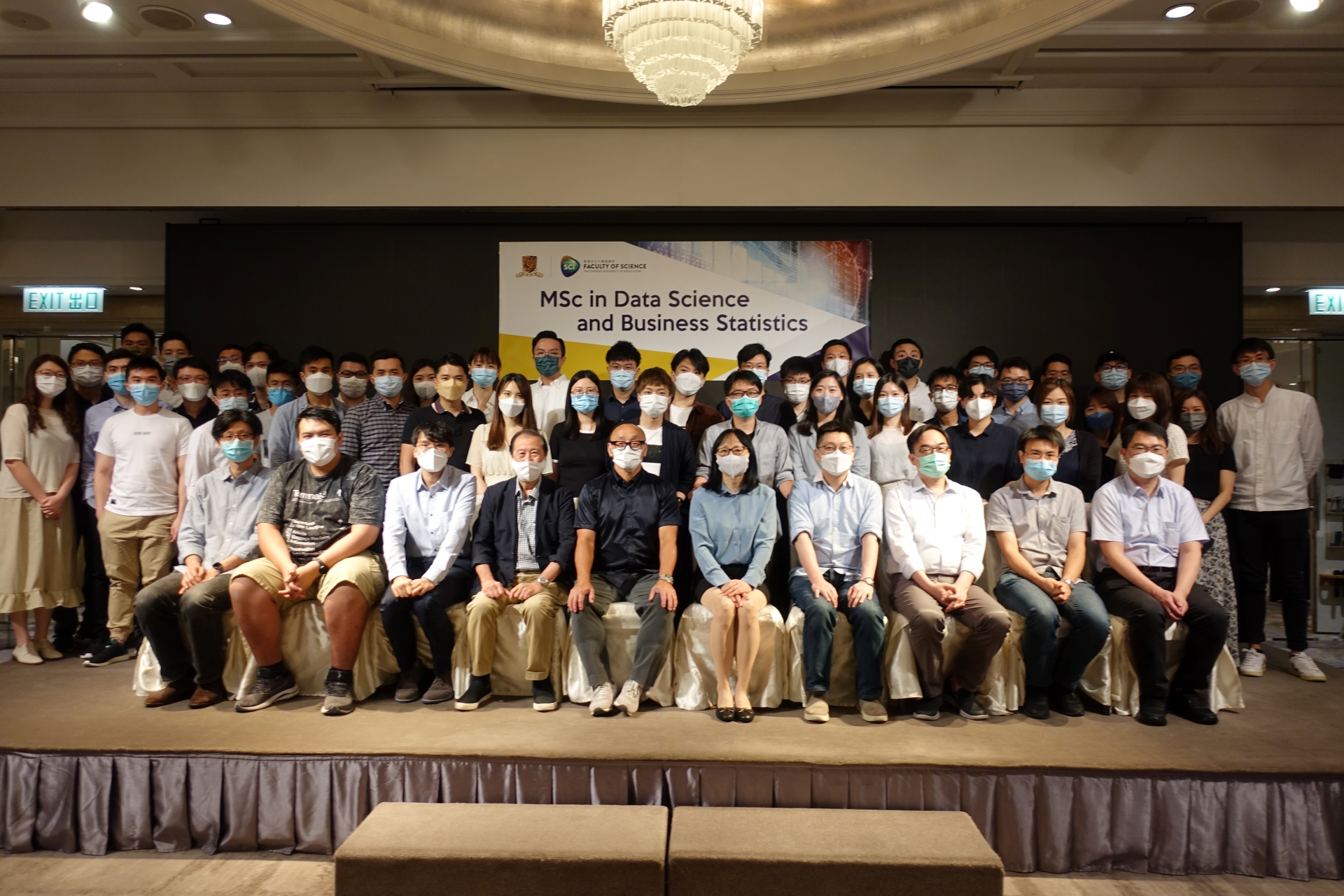

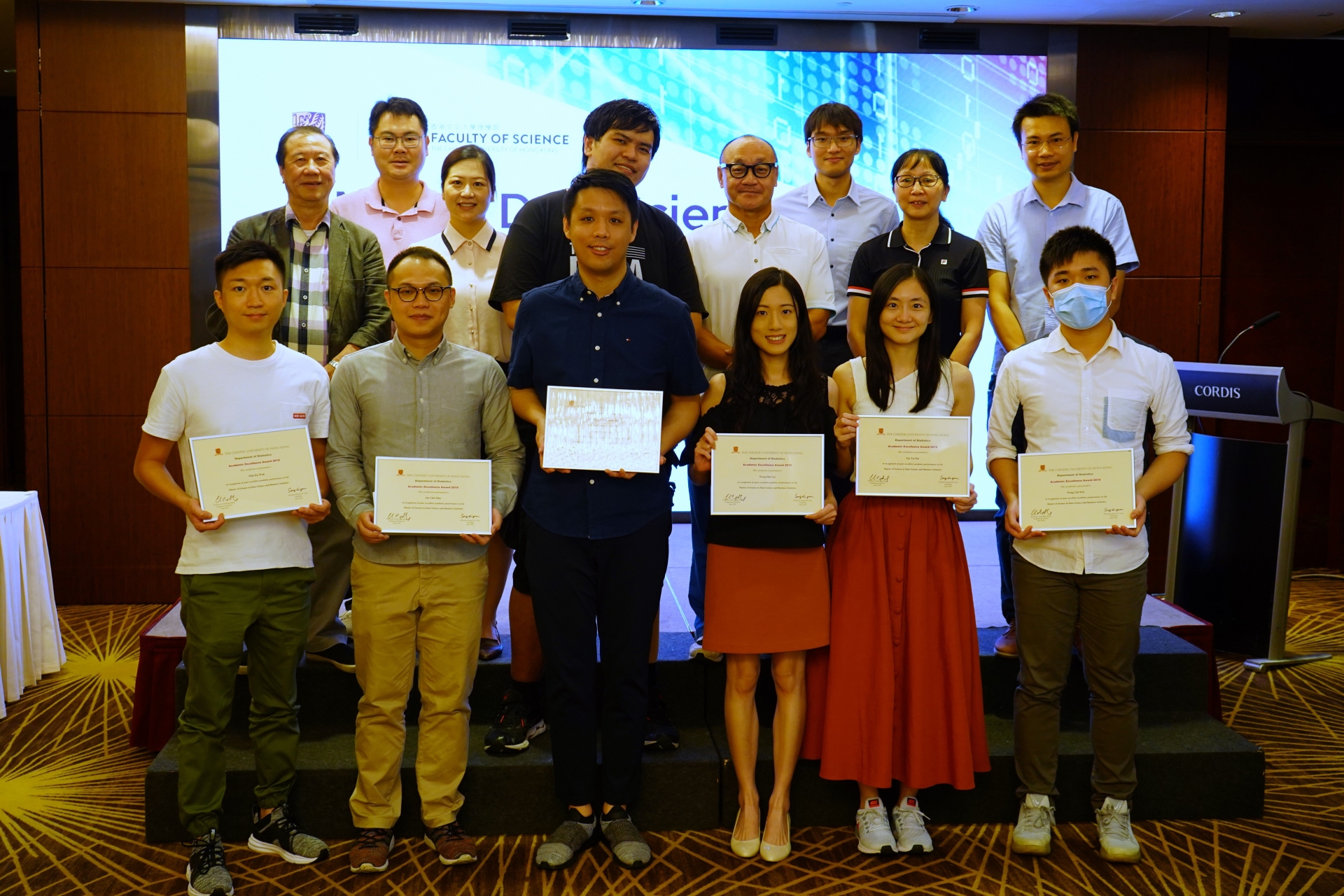

EVENTS & SHARING

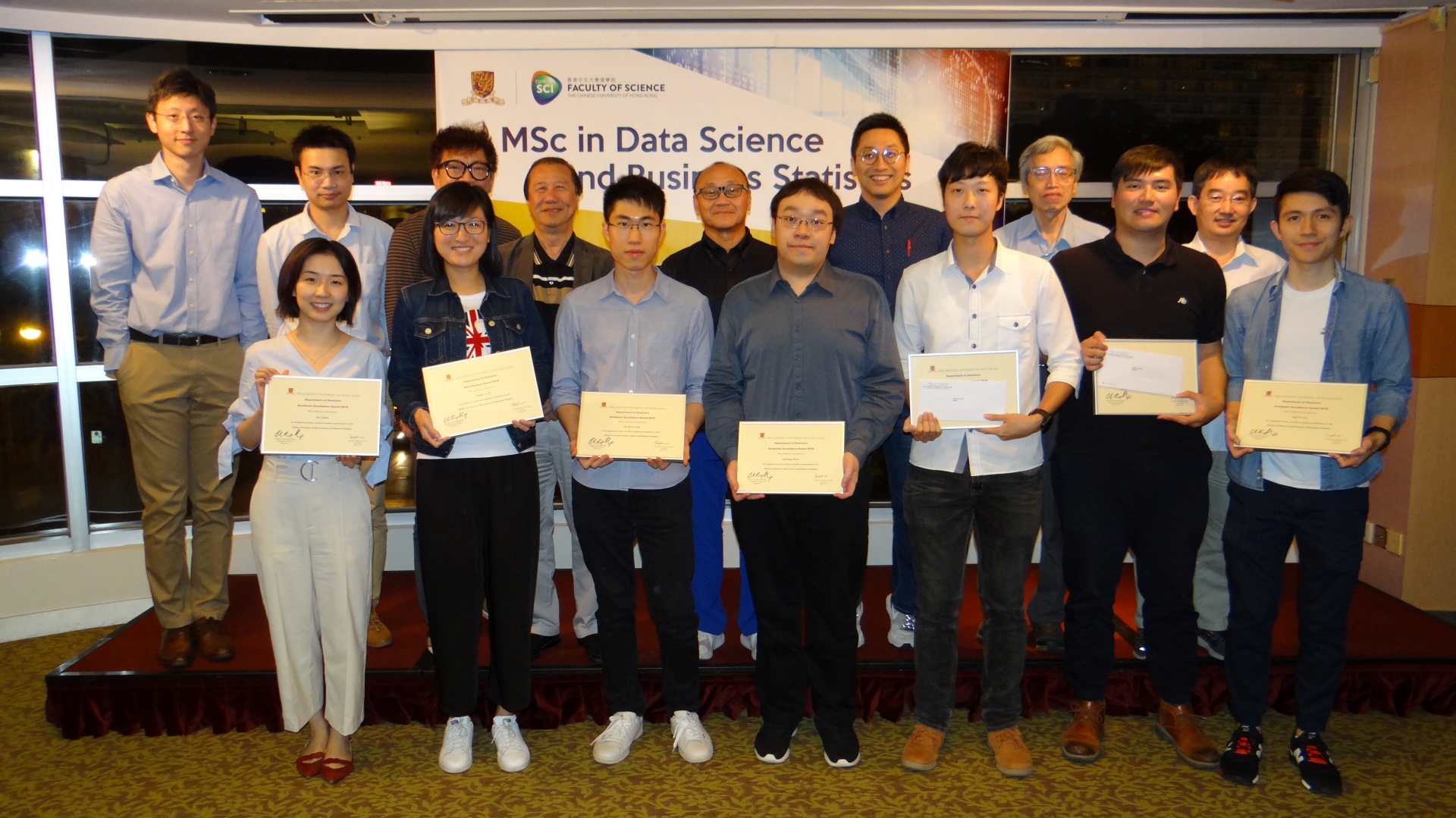

Graduation Ceremony

Anita Ng (class of 2010)

Assistant Commissioner, Rating and Valuation Department, HKSAR Government

Our department has been using multiple regression analysis as a major tool in revaluing a vast number of properties in Hong Kong annually for rating and Government rent purpose. The demand for well-trained staff in data science and computer assisted mass appraisal (CAMA) technique is great.

By studying the DBS programme, I have learned the statistical methods for analyzing and interpreting data. The knowledge gained facilitates my daily work in handling multiple regression analysis and the result interpretation. The subjects themselves are really challenging, but, with support and guidance from the teaching staff, an Arts student like me can still manage them without much difficulty.

Adco Leung (class of 2020)

HSBC

Thank you, CUHK, for this excellent programme on the essential topics of statistics and practical skills for data analysis. I can now confidently construct robust models that maximise signals from datasets. The emphasis on R programming was very valuable because it showed me how to efficiently handle huge datasets and create powerful charts for data visualisation. I recommend this course to anyone interested in learning about data analytics and acquiring a “statistical mindset”, which is critical in our information age.

Clare Liu (class of 2021)

Data Science Specialist, Accenture

The DSBS programme helped me build a strong foundation in data analysis, including essential statistics concepts, data science modelling, coding and financial knowledge. For example, after completing the Regression Model course, I have a deeper understanding of how the logistic regression model works, enabling me to share my knowledge with my teammates at work. This programme is also an excellent opportunity for students to learn from professors and classmates by working on various data-related projects because it encourages all classmates to come up with thoughts, ideas and execution methods. Thank you to the professors, tutors and teaching staff for all the support and guidance.

Vivian Chung (class of 2018)

The programme has given me more knowledge of statistics, and insights into data analysis and data interpretation, which will help me to cope with the demands of the data-driven world. It provides a wide range of theoretical and applied courses which I found very useful and practical, such as Applied Bayesian Analysis and Official Statistics. This programme has definitely helped me to use data more effectively when formulating strategies and policies.

Vigor Fung (class of 2020)

Industry Lead, Google Cloud

The DSBS programme was a great way to expand my knowledge of both theoretical and real-life practical skills in sampling, data analysis and computing while working full-time in the big data field, where I develop data-driven methodologies and use both structured and unstructured data to help enterprises succeed in digital transformation. The programme includes all-round classes from finance, economics and social statistics by experienced and funny professors who always keep you energised in after-work classes.

Luck happens when preparation meets opportunity. Thanks to this programme, it helped me start a new chapter in my career!

Henry Ngai (class of 2018)

Statistician, Census and Statistics Department, HKSAR Government

Statistics is a process of making discoveries, decisions and predictions based on data. In this big data era, statistics permeates almost every part of our lives. A solid foundation and understanding of statistics is crucial. The well-designed DSBS programme equips students with advanced knowledge in statistical theory and its application. The knowledge and hands-on experience from this programme are extremely useful and practical to my work in C&SD, which involves extensive imputation and estimation. Thanks to the world-class professors and teaching staff, I had a fulfilling and rewarding study at CUHK. If you want to gain knowledge in the field of statistics and data science, the DSBS programme is exactly what you need.

Victor Hui (class of 2018)

“To understand God’s thoughts we must study statistics, for these are the measure of his purpose.”

― Florence Nightingale

The DSBS programme distils the essence of advanced statistical knowledge, helping me to sharpen my real-life data-analysis skills. It comprises a diverse range of subjects that complement and extend my engineering background and interests, and equips me with the know-how needed to utilise practical statistical and analytical tools in the workplace. Thanks to the unfailing help of the experienced professors, I now feel confident to dive into further research on data science, so as to better understand God’s thoughts!

FAQS

PROSPECTIVE APPLICANTS

Yes, we do admit students with non-quantitative degrees. We do not have special requirements for undergraduate studies. So, students with non-quantitative degrees are eligible to apply.

We do not expect candidates to have concrete knowledge of mathematics and programming but expect them to feel comfortable using these skills.

You have fulfilled the English language requirement by obtaining a degree from a university in Hong Kong or a degree in which the medium of instruction was English. A score report of an English Language test is not required. You may, however, choose to provide your score report as supplementary information.

The GRE is not required, but you may choose to submit the report as supplementary information.

During the application stage, applicants only need to upload scanned academic transcripts and English reports with the official university seal. There is no need to mail original transcripts and paper supporting documents at this stage. If you receive a conditional offer, you will need to submit original documents as instructed on the admission notice to obtain the firm admission offer.

No, personal statements and CV are not compulsory documents for application. You may upload them as supplementary documents, but it is not a must.

Yes, electronic transcripts are accepted, and you may arrange for submission by email to dsbs@cuhk.edu.hk.

You may amend your information in the application system. However, you will not be able to do so after a certain point in the application stage. If you wish to make amendments, please email us (dsbs@cuhk.edu.hk) and provide the following information:

- Name

- Programme applied

- Application number

- Identity document number

- Information to be amended

Yes, two confidential recommendation letters are compulsory. However, we do not have specific requirements for the referees. They can be academic or non-academic such as supervisors and colleagues at the workplace.

You should submit the information of your referees including their email addresses in the application system. The system will send an invitation email to your referees at 5:00 am HKT the following day. Your referees may use the link and login information in the emails to complete and submit the recommendation letter. You may check the submission status in the application system, but you will not be able to access the confidential recommendation letter.

Please contact us via email if your referees cannot submit the letters through the application system.

We currently do not have a credit transfer mechanism or course exemption scheme.

Applications are reviewed on a rolling basis. Shortlisted applicants will receive an interview invitation via email or phone.

We do not send individual notifications. Unsuccessful applicants may check their status on the application system in July.

The programme is offered by the Department of Statistics, which is government funded. The programme is not funded by the UGC block grant.

CURRENT STUDENTS

You should sign the “Statement of Consent” before starting the CEF course. Eligible students can submit an application form for account opening and fee reimbursement upon successfully completing the CEF course. You may also refer to the CEF website https://www.wfsfaa.gov.hk/cef/en/application/procedures.htm for more information.

Please refer to the Finance Office website https://www.fno.cuhk.edu.hk/student/student-fees/others/ for this information.

The programme currently does not offer students loans or financial assistance. Students may explore financial assistance from other units, such as the Extended Non-Means-Tested Loan Scheme (ENLS) administrated by the Student Finance Office.